UK Taxation of Offshore Funds

There are certain types of offshore fund investments that, when disposed of, may trigger an income tax charge instead of a capital gains tax charge.

The rationale behind HMRC assessing any gains on the disposal of certain offshore fund investments as offshore income gains arises from how the entity reports the income derived from the underlying shareholdings of the fund.

Many offshore funds grow by accumulating and reinvesting some or all of their income.

An investor who does not receive a distribution from the fund will neither pay income tax on the accumulated income as it accrues to the fund nor at the time of disposing of their units.

This is because the accumulated income has been capitalised.

The offshore fund legislation aims to prevent this roll-up and conversion of income into capital. It achieves this in part by classifying offshore funds as either transparent or opaque.

Transparent and Opaque Funds

A transparent fund is one where any income received from the shareholdings owned by the fund is taxable on the investor directly.

The fund manager should provide the investor with a voucher detailing the proportion of the fund’s income to which they are entitled. Because there is no loss of income tax revenue, gains from transparent funds fall within the capital gains tax regime, so they will not be considered further here.

Many offshore funds are opaque for tax purposes. With an opaque fund, the investor is regarded as owning units in the fund, rather than a proportion of the underlying assets. Any voucher provided by the fund manager is likely to include only income that has actually been distributed to the investor.

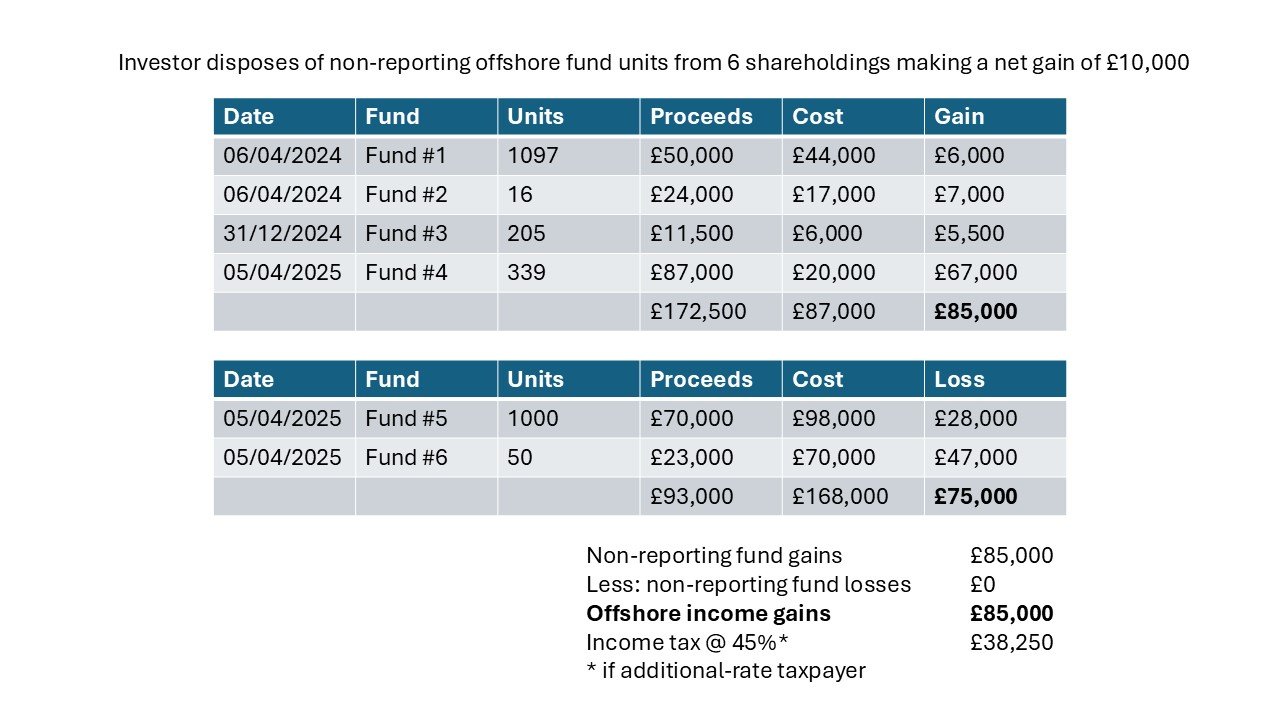

HMRC will assess any gains made by a UK-resident investor disposing of their units in an opaque offshore fund to income tax, unless the fund has adopted UK reporting fund status.

Any offshore fund losses continue to be treated as capital, so they cannot be offset against gains from non-reporting funds.

UK Reporting Fund Status

UK reporting fund status gives a UK-resident investor capital gains tax treatment on the disposal of their units in an opaque offshore fund.

An offshore fund that has entered the UK reporting fund regime is required to disclose to HMRC the income it has accumulated during a reporting period.

Income earned by a reporting fund during a reporting period but not distributed is known as excess reportable income (ERI).

A UK-resident investor is subject to a dry tax charge on ERI, meaning they must pay tax on income they have not actually received.

ERI is calculated by multiplying the ERI rate by the number of units held by the investor on the last day of the reporting period.

This ERI must be included on the Foreign Supplementary Pages of the investor’s Self-Assessment tax return.

ERI is deemed to be distributed to the investor on the earlier of:

the date the report is made available to the investor, or

six months after the end of the reporting period.

This deemed distribution date is the date on which the ERI is treated as earned for income tax purposes.

ERI charged to income tax should be added to the base cost of the investor’s units, thereby reducing the capital gain on a future disposal.

If an investor establishes that they own units in an offshore fund, they should consult HMRC’s approved reporting funds list to check whether the fund is included. If the fund is on the list, the investor should consider the reporting fund effective date and the cessation date, where applicable.

Has the fund changed its reporting status during the investor’s period of ownership?

Election and Deemed Disposal

If a fund has not been a reporting fund throughout the investor’s entire ownership period, any gain arising from the disposal of their units will be charged to income tax, unless an election has been made.

An investor may choose to make an election, via their tax return, to treat themselves as having disposed of their units on the day the fund converted to or from being a reporting fund.

The deemed consideration is equal to the net asset value (NAV) of the investor’s interest in the fund.

NAV represents the net value of the fund, and the price per unit can be calculated by dividing the total assets less total liabilities by the number of units in the fund.

Where a fund converts from a non-reporting to a reporting fund, any gain arising on the deemed disposal will be assessed as an offshore income gain.

The base cost of the investor’s units is then uplifted, and any gain arising on the actual future disposal of the units will be subject to capital gains tax.

If the units stand at a loss on the day the fund acquires UK reporting fund status, no election is required. Instead, the investor is treated as having been invested in a reporting fund since the original acquisition date.

If a reporting fund ceases to be a reporting fund, any gain on the deemed disposal will be assessed as a capital gain, with any post-conversion gains taxed as offshore income gains.

Identifying Offshore Funds

There are many different types of offshore funds, so the starting point is to refer to the documentation provided by the fund manager.

If the documentation confirms that the fund is a reporting fund, refer to HMRC’s approved offshore reporting funds list to check whether this remains the case and when the fund entered the reporting fund regime. An ISIN number makes identification much simpler.

If the documentation is silent on the reporting status of the fund, or if no documentation is available, you may need to consider the following questions to establish the fund’s reporting status:

1. Is the investment in a mutual fund?

2. Is the investment an offshore fund?

What is a Mutual Fund?

A mutual fund must meet the following three conditions:

Condition A: The purpose or effect of the arrangements is to enable participants to benefit from the acquisition, holding, management, or disposal of assets held by the fund.

Condition B: Participants do not have day-to-day control over the management of the property.

Condition C: A reasonable investor would expect to realise their investment entirely or almost entirely by reference to the net asset value (NAV) of the assets under management or, alternatively, by reference to an index (e.g. a stock market index).

What is an Offshore Fund?

An offshore fund is a mutual fund that meets one of the following criteria under s.355(1) of TIOPA 2010:

A mutual fund constituted by a body corporate resident outside the United Kingdom (s.355(1)(a)):

Offshore unit trusts

Open-ended investment companies

Société d'Investissement à Capital Variable (SICAV)

A mutual fund where property is held in trust for participants by trustees resident outside the United Kingdom (s.355(1)(b)):

Jersey Property Unit Trust (JPUT)

A mutual fund constituted by other arrangements that create co-ownership rights, where the arrangements take effect under the law of a non-UK jurisdiction (s.355(1)(c)):

Common Contractual Funds (CCFs)

Fonds Communs de Titrisation (FCTs)

Please note that this post is intended for general informational purposes only and should not be considered legal or tax advice. Always seek professional guidance tailored to your specific circumstances.